defer capital gains tax canada

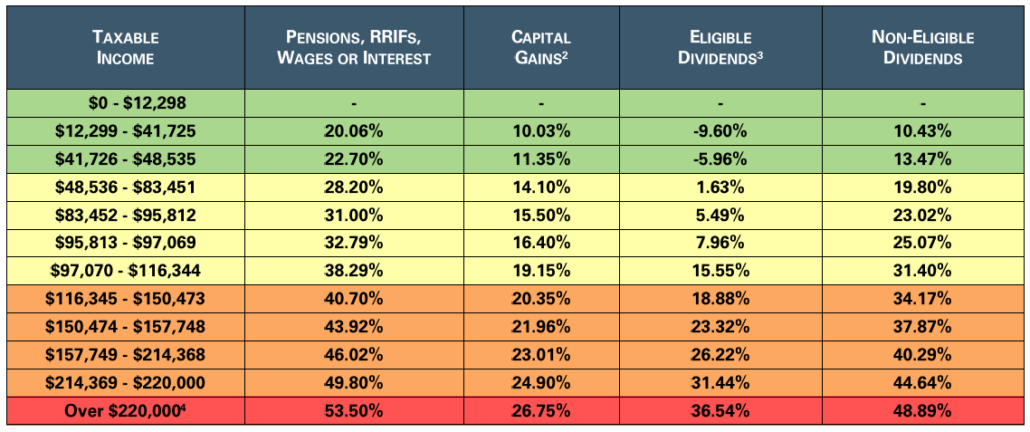

The permitted deferral of the capital gain from the disposition of eligible small business corporation shares is determined by the following formula. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales.

. A 100000 capital gain for someone with 75000 of other income in Ontario will generate about 18930 of tax payableunder 19. The 1031 Exchange is the holy grail of tax deferral opportunities. A Brief History of the Capital Gains Tax in Canada.

In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44. Capital gains deferral B D E where B is the total capital gain from the original sale. For the purposes of the capital gains deferral the CRA considers you to have acquired such shares at the time and under the same circumstances that the related.

Generally the timing of the tax is controlled by. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains. However under the Rollover of Gain on Sale of Principal Residence rule that capital gain could potentially be deferred.

Deferred capital gains taxation refers to taxes that are only applied to the gain in value on an investment. 1972 - it started with a 50 Inclusion Rate and all prior. Deferred Capital Gains Taxation.

Claiming a capital gains reserve When you sell a capital property you usually receive full payment at that time. This is a grave mistake that could lead to bad tax consequences. E is the proceeds of disposition and D is the lesser of E and the total cost of all.

However sometimes you receive the amount over a number of years. A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you. And in Quebec someone with 150000 of.

January 1 2022 is the 50th anniversary of the capital gains tax. There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal. Deferral election is not taken but can claim CCA Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly.

For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. If that taxpayer purchased a new home for 250000 they. Capital gains deferral for investment in small business Eligible small business corporation shares Calculating the capital gains deferral ACB reduction Other transactions Property included in.

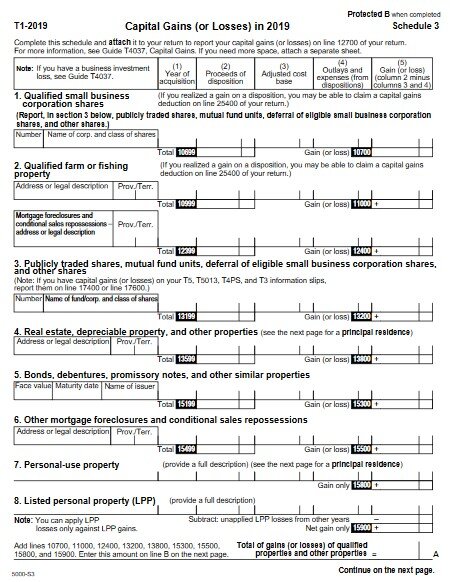

To claim this reserve form T2017 in schedule 3 must be completed and submitted with your. However the Canada Revenue Agency CRA allows Canadians to defer capital gains on capital property sale using the capital gains reserve discussed below. Capital gains deferral B x D E.

The gain is deferred until December 31 2026or to the year when the. As long as you are a resident of Canada you can claim the capital gains reserve.

Pay Less Tax On Your Capital Gains The Independent Dollar

How Do I Report Capital Gains In British Columbia

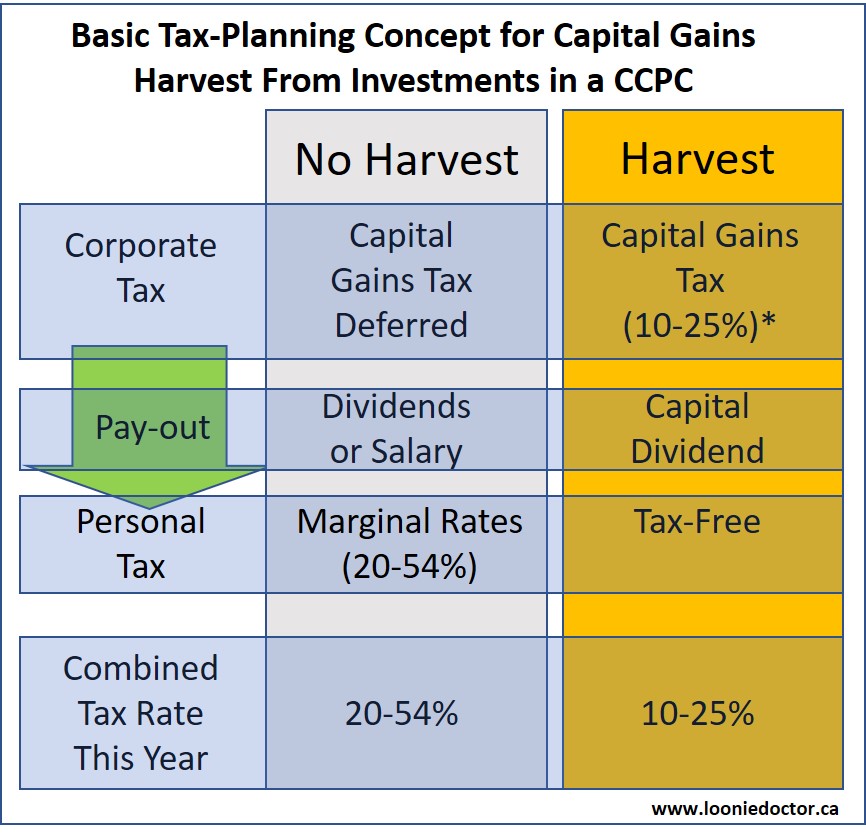

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

.jpg)

Defer Capital Gains By Investing In Qualified Opportunity Funds Bny Mellon Wealth Management

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

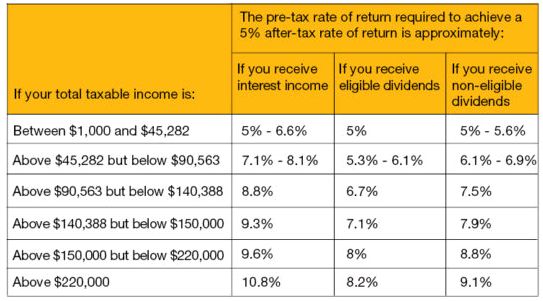

Investment Income Taxation Intelligent Design Or Jurassic Park Physician Finance Canada

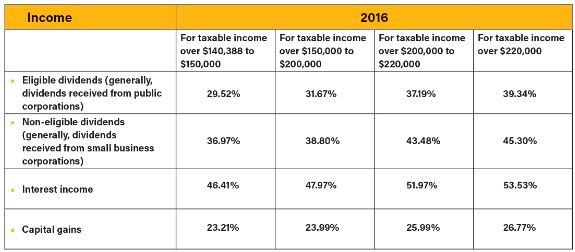

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

How To Defer Capital Gains Tax On Real Estate Sales Madan Ca

How Capital Gains Tax Works In Canada Forbes Advisor Canada

How To Avoid Capital Gains Tax In Canada Remitbee

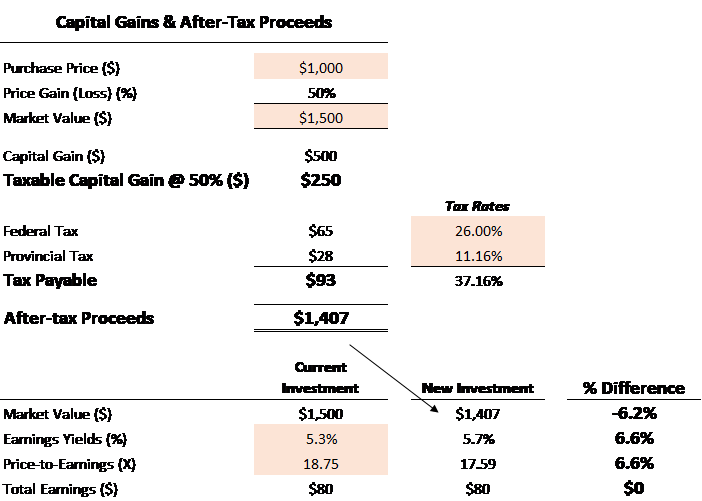

Capital Gains Tax Calculator For Relative Value Investing

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Defer Capital Gains Tax When To Pay Taxes Manning Elliott

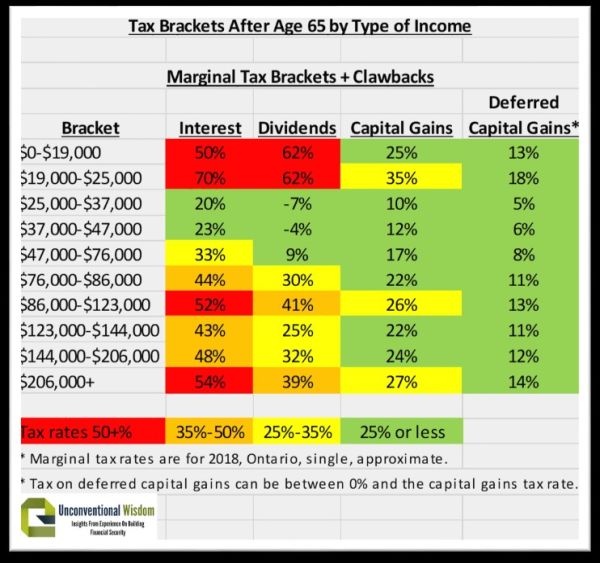

5 Categories Of Tax Planning Alitis Investment Counsel

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy